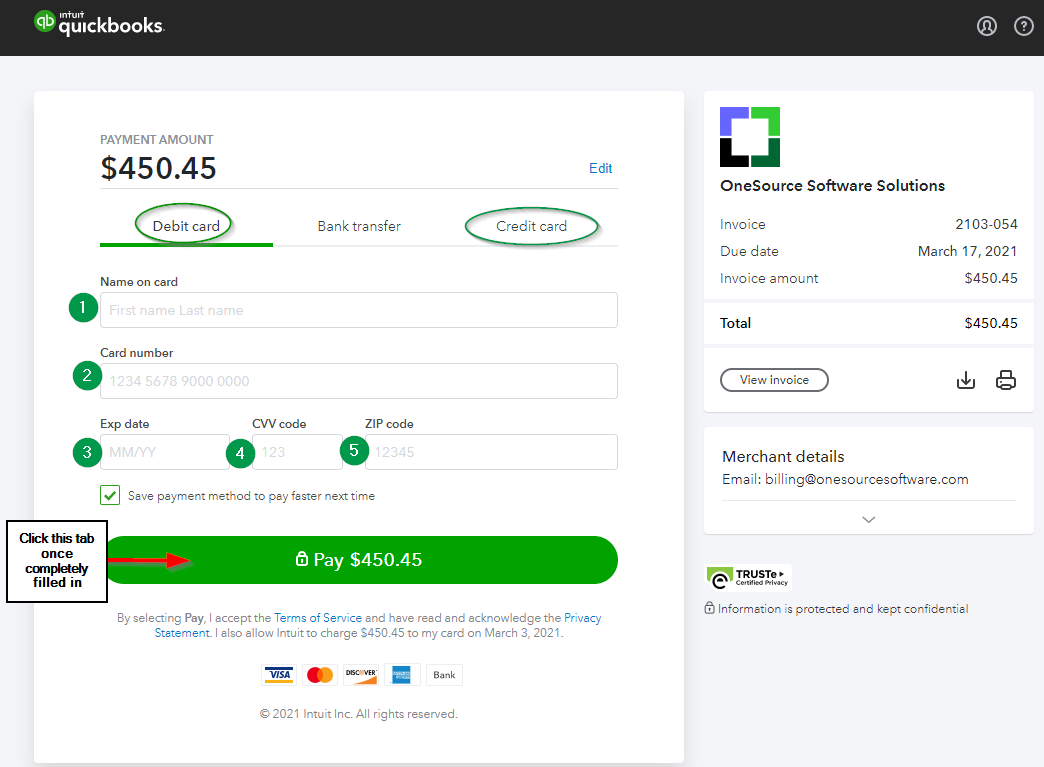

- If you choose Credit Card or Debit Card payment method:

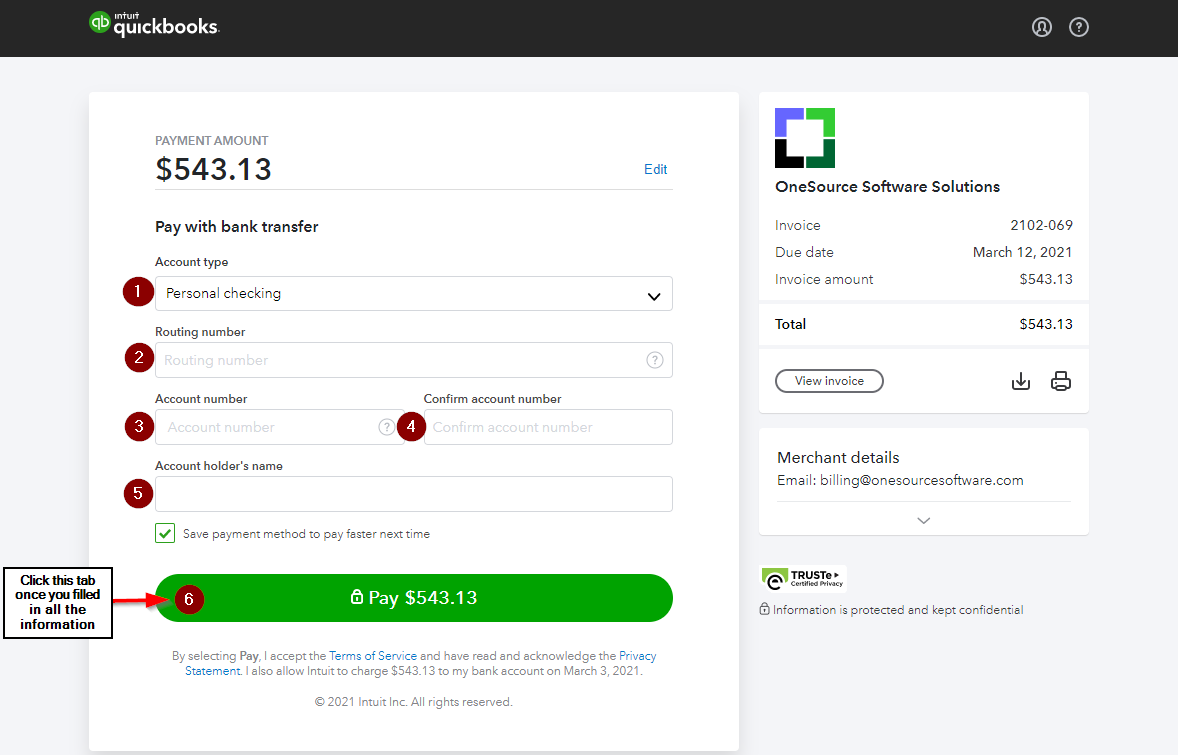

How to Pay an Invoice Using ACH

What is an ACH?

An Automated Clearing House (ACH) Network is a computer-based electronic funds-transfer system run by the former National Automated Clearing House Association (NACHA) since 1974, usually domestic low value payments, between participating financial institutions. It may support both credit transfers and direct debits. The ACH system is designed to process batches of payments containing numerous transactions and charges fess low enough to encourage its use for low value payments.

The payment system provides ACH credit transfers such as:

- direct deposit for payroll

- Social Security and other benefit payments

- tax refunds

- vendor payments

ACH direct debit transfers includes consumer payments on:

- Insurance premiums

- Mortgage loans

- And other kinds of bills

Uses of the ACH payment system

- Bank treasury management departments sell this service to business and government customers

- Business-to-business payments

- Direct debit payment of customer bills such as mortgages, loan, utilities, insurance premiums, rents, and any other regular payment

- Direct deposit of payroll, Social Security and other government payments, and tax refunds

- E-commerce payments

- Federal, state, and local tax payments

- Non-immediate transfer of funds between accounts at different financial institutions

Types of ACH transactions

For each ACH payment from a payor's bank account to a payee's bank account, there are effectively two ACH transactions created and transmitted, namely an ACH Debit transaction and an ACH Credit transaction. In the case of a payor and payee having an account at the same financial institution, there is only one ACH transaction, which is often called an "on-us" transaction.

ACH Debit transaction

- The payee's sending institutions creates, batches, and transmits an ACH Debit transaction to the payor's receiving institution. The ACH Debit transaction instructs the receiving institution to withdraw and transmit the funds from the payor's bank account to the sending institution. The receiving must send the return to the sending institution by the end of the following business day if it is unstable to debit the funds from the payor's account, such if the account was not found, the account was closed, or the account was frozen. For an ACH Debit transaction, the sending institution may be a third-party bank, rather than the payee's bank.

ACH Credit transaction

- The payor's sending institution creates, batches, and transmits an ACH credit to the payee's receiving institution. The ACH Credit transaction the receiving institution to credit the funds to the payee's bank account. The receiving institution must send the return to the sending institution by the end of the following business day if it is unable to credit the funds to the payee's account such if the account was not found, the account was closed, or the account was frozen. For an ACH Credit, the sending institution may not be a third-party bank, rather than the payor's bank.

Types of ACH Settlements

There are two types of ACH settlements.

Next-day ACH

ACH debits and credits are transactions that are created, batched, and transmitted to an ACH operator, typically by way of a financial institution's connection to the ACH Network.

With next-day ACH, each ACH transaction is cleared overnight. The sending institution (called the Originating Depository Financial Institution) sends the transaction to the receiving institution (called the Receiving Depository Financial Institution). When the receiving institution receives the transaction, it has until the end of the next working day to send a rejection to the sending institution. If the sending institution does not receive a return from the receiving institution by the morning of the third business, then the transaction is deemed to be successful.

Waiting for a timeout for two business is an antiquated feature of ACH that lingers on from the 1960s when the ACH system was designed and implemented. It is not as quick as real-time payment networks. Consequently, ACH debit or credit transaction can take four working days to complete.

Same-day ACH

With the same-day ACH, settlement can happen the same day. The sending institution can transmit files to the receiving institution the same day, expediting the processing of ACH transactions. The receiving institution still has two business days in which to send a return, so there will still be a delay of two business days in same-day ACH debit transactions. On the other hand, ACH credit transaction can be the same business day as long as the receiving institution receives the ACH transaction within the correct window.

Transaction exceeding $100,000 and international transactions are not eligible for same-day ACH.

NACHA instituted same-day ACH four phases. As of September 15,2017, banks were required to accept debit requests in the same three settlement windows. As of September 23, 2016, financial institutions were required to be able to process ACH credit requests to add funds to an account in all settlement windows. As of March 16, 2018, banks were required to make funds available as fully settled completed transactions by 5:00 p.m. local time for ACH credit transactions processed in the day's first two settlement windows. As of March 20, 2020, the per-transaction limit was raised from $25,000 to $100,000.

How Do ACH Payments Work? (From Our Customer's Point of View)

ACH payments go through several steps to ensure the security of the transaction (the "clearing" part of the "clearing house"). Here are the basic steps for making an ACH payment to a vendor:

- Your business- the "payment originator"- initiates the payment by authorizing the transaction.

- Your bank, known as the Originating Depository Financial Institution (ODFI), records the transaction.

- The OFDI sends batches of ACH requests one to three times each day to the ACH operator.

- The ACH operator receives the batches, accept the requests, and processes them, making sure they get to the correct financial institution and account.

- The ACH transmits the requests to your vendor's bank, referred to as the Receiving Depository Financial Institution (RDFI).

- The funds should reach the vendor's account within one to three business days; meanwhile, you'll see a debit in your account showing that the payment has been deducted. Nacha rules determin the timeline, although a recent rule makes some payments are eligible for same-day payments, referred to as "same-day ACH"

How to Make ACH Credit Payments (From Our Customer's Point of View)

- Contact your financial institution regarding your access to online bill pay features.

- See if your intended recipient is eligible for ACH credit payments via your bank.

- Determine if you are making an ACH credit or a "paperless" paper transaction.

- Set up recurring payments if desired.

How to Make ACH Debit Payments (From Our Customer's Point of View)

- See if your intended recipient allows ACH debit payments.

- Follow the recipient's procedures for setting up ACH debits.

- Keep an eye out for a small test transaction.

- Set up your payment parameters and wait for your ACH debits to begin.